Contents:

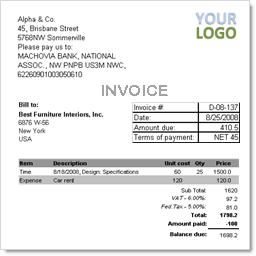

Even a tiny error while setting up payroll taxes might lead to significant errors when you ultimately run your employees’ paychecks. Each pay period, your payroll must balance with your ledger’s payroll expense account. The payroll reconciliation process helps you keep accurate accounting records, which are necessary for tax filing and measuring financial health. You check that the transactions in your books equal the payroll register. You should assess if the transaction amounts are appropriate after identifying the transactions that contribute to each payroll liability account’s ultimate balance.

When it comes time to remit payroll taxes, you’ll be happy you spent a few extra minutes reconciling your payroll. QuickBooks makes it easy to reconcile your payroll liabilities. Its payroll service and accounting features are integrated, which helps ensure that your payroll data is accurate in both systems. Downloading spreadsheets for payroll reconciliation will make it easier for you to keep track of account activities. Payroll Liabilities include both employer expenses and employee liabilities.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

No matter the https://bookkeeping-reviews.com/s, you’ll need to make sure that employee salaries and wages match what’s in your general ledger. You’ll also need to confirm that you have the correct salaries and wages in your payroll register before processing payroll. Most companies deposit tax liabilities using the electronic federal tax payment system .

Print out your payroll register

A part of the employee’s paycheck should be recorded as a liability because it is an expense. You will see that even though the payroll liabilities accounts have transactions in them after entering both checks, they net out to zero. QuickBooks is a staple in accounting solutions, but the company also has a terrific online payroll service.

This causes major headaches and hassles come tax time—plus the potential for more penalties. Reports you may need to gather from your payroll software are a payroll register, payroll tax report, payroll deduction report, etc. You might also need to print payroll cash reports or itemized invoices from your benefit vendors if the issue requires more in-depth research.

Employee Working Hours

If that happens, there is a good chance the business in understating their profit and then budgets and forecasts become inaccurate. If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history. All payroll accounting transactions should be recorded precisely in your books. It is required to debit and credit them correctly so as to ensure the right calculations.

comprehensive income is likely one of the biggest expenses your business has, which is why it’s important to get it right. The easiest way to do that is by performing a payroll reconciliation each pay period. The reconciliation of payroll doesn’t have to be difficult for small business owners.

It’s important not to neglect your liabilities, or your company could face some serious setbacks. It is important to know your specific payroll liabilities. Running payroll reports and analyzing them each month will help you create an accurate budget, understand your labor costs and manage your small business’s cash flow.

Why Payroll Reconciliation Is Important for Your Small Business

Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. Payroll reconciliation sounds daunting, and it’s yet another thing on your plate as a small business owner. Payments Everything you need to start accepting payments for your business.

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-5.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-all.jpg

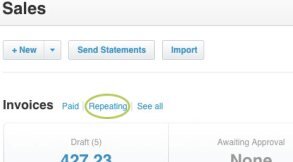

Her experience has allowed her to learn first hand what the payroll needs are for small business owners. Although having payroll software makes paying your employees the right way much easier, you still need to know the basics. Check out our tips on the best payroll training to help. After printing your reports, it’s a good idea to download the transactions from QuickBooks into an Excel spreadsheet. It makes it easier to organize the transactions so it’s clear which amounts cleared and which did not. By adding QuickBooks Payroll to your current QuickBooks Online subscription, your company will have immediate access to features for processing payroll and HR tools.

The payment of the withholding is what zeros out with the payroll liabilities. The employer’s share of the taxes is an expense that goes on the income statement, along with the gross payroll expense. The right accounting software means a business doesn’t have to worry about wage or tax calculations. Most solutions are affordable, automate processes, and eliminate human error.

Zero Out Liabilities in QuickBooks are withholdings and deductions that are taken from your employees’ gross salary. These deductions are the amounts that are owed to a third party. If you’re familiar with your regular payroll totals, you’ll be able to look at the register and see if the payroll total is too high or too low. Business owners love Patriot’s award-winning payroll software.

How to reconcile payroll in 6 easy steps

When you need to investigate payroll liabilities, this will enable you to organize data much more quickly. Deductions from your bank accounts for payroll are offset by the payroll clearing account. Payroll details reports provide details such as past paycheck amounts, taxes and deductions. QuickBooks Online payroll reports give you a snapshot of your business’s employees and pay data. Payroll errors can add up quickly if your employees aren’t in the right category.

Accounts Payable Job Description, Roles/Responsibilities, and … – InfoGuide Nigeria

Accounts Payable Job Description, Roles/Responsibilities, and ….

Posted: Tue, 07 Mar 2023 10:40:52 GMT [source]

Account for overtime pay, double time, and unpaid time that would normally be paid. Also, make sure all pay rates are current, such as if you gave an employee a raise last pay period. Look at past payrolls to see if the current pay period is similar.

Get the team on board to understand that the purpose of these meetings is to enhance the payroll reconciliation process’s accuracy and efficiency. Year-end payroll reconciliation can be a tedious process, but it’s a necessary one. Consider scheduling a debriefing meeting at least once a year to examine your reconciliation process.

Or maybe you messed things up in the opposite direction. Your employee was entitled to a $800 paycheck, but you only gave them $750. Even though it wasn’t intentional, now you’ve underpaid them and could be subject to penalties. When dealing with benefit premiums, you might need to pull the related invoice to see who you were charged for and how much. You’ll also need to take a deep dive into the payroll deductions you received for the period.

Below shows the employee contact list exported into Microsoft Excel. If you have run payroll in the past, all payroll-type reports should be populated here, as well as employee-type reports. You will see any reports QuickBooks Online can generate for your business. For example, if your business does not have multiple worksites, you will not see the multiple worksites report.