Содержание

The Bloomberg Terminal offers such services that make the most of innovative technologies. The Bloomberg Terminal’s OMS solutions are designed in such a way that it is pre-integrated with the rest of Bloomberg’s enterprise services. This way the system can offer a truly holistic suite of solutions from front to back office. For buy-side firms, it’s Asset and Investment Manager can offer solutions such as global, multi-asset solutions for portfolio management, trading, compliance and operations. What also comes into play is Bloomberg’s Sell-Side Execution and Order Management Solutions .

These function bring up a page of the top news stories of the day, which are updated on an ongoing basis. Within the function, there are additional sub-menus that will allow you to view news stories that are filtered byasset class, geographic region, or topic. One of the nice features of Bloomberg is that it has a fairly robust messaging system. This system allows users to stay in contact with other users and is one of the reasons that Bloomberg is so ubiquitous in the financial industry. You can look up other users of the system in order to send them a message, and if you contact someone regularly, you can set them up on speed-dial as well.

Because so many OTC trades occur through the chat, it’s become invaluable for doing business. And because trades are made through it, lots of intra-firm communication also goes on there too. But, back in the 1980s, when Michael Bloomberg created the product, he sold them as individual computer systems called terminals, and the name stuck since then. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

Yahoo Finance

This is an awesome Bloomberg tool that looks at the default risk of a particular company. Factors like long-term debt, share price, interest expenses, and market capitalization are adjustable to create various if/then scenarios. For example, if TSLA drops to $150 a share, then the Bloomberg proprietary default risk will be approximately x%. Bloomberg also allows clients to compare and contrast equities side by side, offering a comparative analysis of any two equities. Comparison fields includefundamental analysis, historical ratios, and technical charting. In addition to comparative functionality, Bloomberg also includes screeners, allowing clients to screen for stocks using a multitude ofmetrics.

Although this is another bond market screen, you will notice that it covers a broader array of securities than the PX1 function discussed above. Treasuries, the BTMM screen shows markets for a wide variety ofmoney marketinstruments, as well as mortgage-backed bonds and currencies. The BTMM screen also includes quotes on the Dow, Nasdaq, and S&P, as well as oil. Forportfolio managersandbrokers, having the ability to access real-time market information from almost anywhere in the world, is an incredibly convenient and important advantage of a Bloomberg subscription. OpenBB empowers millions of individual investors with access to leading-edge financial research.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Share this Comment:

The “des” is the abbreviation for description pages on Bloomberg, and this common function will provide a good general overview of most securities. SaaS or Software as a Service uses cloud computing to provide users with access to a program via the Internet, commonly using a subscription service format. From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst. The most common professions to use this data provider are investment banking, equity research, and sales & trading. Allows for analysis of credit worthiness of a debt issuer or specific fixed income security by displaying both current and historical credit ratings from different ratings agencies in one screen.

Tumbling Tokyo Prices Gives Ueda Breathing Space – Investing.com

Tumbling Tokyo Prices Gives Ueda Breathing Space.

Posted: Fri, 03 Mar 2023 11:59:00 GMT [source]

Financial data providers are a key part of a finance professional’s workflow. This basic guide to Bloomberg has provided an introduction to one of the most practical tools participants in the financial markets can use. Unfortunately, Bloomberg can be expensive, which means that having a home system may not be practical for many readers. On the positive side though, it is often possible to access a Bloomberg terminal through a public site such as a library or university. Once you begin using Bloomberg, you will undoubtedly find a great many more tools that fit your particular investment and trading style. He was given no severance package, but owned $10 million worth of equity as a partner at the firm.

Can You Trade Directly From a Bloomberg Terminal?

The representative you speak with can then take down details of what you are looking for and have someone from the sales team contact you. Pricing and terms of the contract are unique to each user and would be discussed when the sales team contacts you. If I ever start a hedge fund, I’ll use @openbb_finance , not Bloomberg. Great companies are formed at the intersection of disruption and value.

The PX1 screen is a little bit more focused on the U.S.Treasury bond market, while also giving updates on the Dow, Nasdaq, S&P, as well as the gold and oil markets. Fixed income electronic trading platform for U.S. rates and a broad set of global sovereign debt. Gives an overview of currency rates in real time, also provides information on pricing hours for better monitoring.

- TAM Workshop – This quick tutorial goes over the basics of market sizing and includes some good creative resources for finding data.

- The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders.

- The terminal implements a client-server architecture with the server running on a multiprocessor Unix platform.

- Factors like long-term debt, share price, interest expenses, and market capitalization are adjustable to create various if/then scenarios.

But, if you’re looking for a bloomberg terminal cost in india that is powerful, customizable, and offers a breadth of data, then Koyfin might be the right fit. If you’re on the fence about whether or not to give Koyfin a try, you may want to note that this platform is free to all users. Even though there are plans in the works to release a paid service that will offer additional data, functionality, market coverage, and customization, Koyfin will continue to offer a free version. The terminal’s keyboard layout was designed for traders and market makers who had no prior computer experience. The look and feel of the Bloomberg keyboard are similar to an ordinary computer keyboard, with several enhancements which help users navigate through the system. The Bloomberg Terminal is designed to deliver valuable information across various asset classes.

Technology Services

Bloomberg LP offered quick, high-high quality business information to Wall Street. In the early Eighties, the company sold its first financial data system to Merrill Lynch, now a part of Bank of America Corp. . The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable.

The downside of this approach is that you won’t be able to customize the system and will have to share it with other users. However, for many users these drawbacks may be outweighed by the cost savings over subscribing to the system as an individual. In 2018, Thomson Reuters completed a deal with the private equity firm Blackstone, selling a 55% stake in the company for approximately $17 billion in gross cash proceeds. Bloomberg charges an annual subscription fee, with the price for the proprietary electronic trading system at an estimated $27,660 per year, as of 2020.

But it does charge a lower price—currently about $20,000 a year—for customers with two or more subscriptions, including large banks than can have hundreds of terminals. That price, however, increased proportionally with the single-terminal price over the past decade. Similar to the historical price screen for equities, we are able to view historical day-over-day changes in security values, along with implied yield-to-maturities, for any given day. Additionally, credit ratings andcost of capitalinformation is available for fixed income securities. Eikon offers its user access to cross-asset calculators, portfolio analytics, and StarMine quantitative analytics and models, which is why it stands out as the best terminal for financial data and analytics. FactSet has been helping its financial clients since the late 1970s and has 37 offices in 20 countries and serves over 162,000 financial professionals.

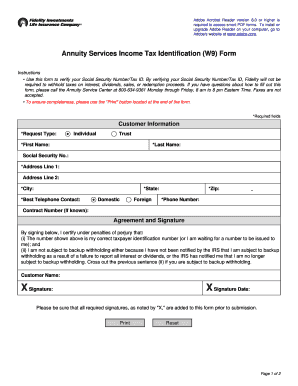

A Bloomberg spokesperson confirmed the price increase but declined to comment on feedback from clients or to provide data on past price increases. “The price increase in nominal terms will be $195 per month per subscription. This is consistent with Bloomberg’s historical practice and links our price increase to global inflation,” it adds. To make matters worse, three of India’s six operating LNG terminals are running below 20% capacity due to high spot rates and infrastructure challenges, such as the lack of a connecting pipeline network. In addition to using Bloomberg functions on the Terminal, analysts must also be good at integrating Bloomberg into Excel.

The https://1investing.in/ Terminal enables businesses in India to better understand the world and maximise success. Bloomberg has witnessed India transform from an advancing emerging market to the fastest-growing economy globally. It is Windows-based and compatible with Excel which provides a more simplified view of the data.

Beyond that there are also several other tutorials available to those interested in learning more, including those offered directly from Bloomberg itself. Furthermore, many Colleges and Universities are offering Bloomberg courses, to help students gain early exposure to the most widely used tool for real-time financial data in the world of finance. Once you are equipped with some training, it is just a matter of sitting down with the system and familiarizing yourself with it. As with many systems, in the end the best way to learn Bloomberg is through hands-on trial and error.

Joe Biden, Olaf Scholz pledge Ukraine support at White House talks

The server side of the terminal was originally developed using mostly the programming languages Fortran and C. Recent years have seen a transition towards C++ and embedded JavaScript on the clients and servers. This is essentially a Terminal-wide chat function that allows traders to chat with brokers, portfolio managers to talk with each other, or simply for intra-firm communication, perhaps to run something by compliance. You’re on the go and need to access financial data from a variety of computers. While Bloomberg access requires a dedicated terminal and FactSet access requires a software installation on each machine, your Capital IQ account can be accessed from a web browser anywhere.

With a series of model portfolios, YCharts makes it simple to build, visualize, and compare investment strategies. Users can create custom reports to compare portfolios or securities using client-friendly visuals. YCharts also includes an Excel add-on that comes with a series of powerful and customizable templates that can be used to fit any model that you create.